ValiDAO: Organic Free Range Validators

6/18/2024

Disclosure:

ASXN and ASXN staff have exposure to ValiDAO. Additional disclaimers can be found at the end.

Introduction

ValiDAO is a DAO-owned validator entity. They operate blockchain infrastructure (including validators, RPCs, IBC relayers and DA nodes) in underrepresented geographical locations and jurisdictions (currently: Iceland) while leveraging crypto-native dePIN solutions. They offer users the unique ability to participate in the validation process and own the infrastructure on which this validation is performed.

Industry Overview

ValiDAO operates within the validation and decentralised infrastructure industry, with the main business line being validation of Proof of Stake (PoS) networks. Proof-of-Stake is a consensus mechanism many networks use to validate transactions and secure the network. Unlike Proof-of-Work (PoW), which relies on computational power and energy consumption, PoS requires participants to ‘stake’ or lock assets into the network to provide cryptoeconomic security, as the stake can be forfeited/slashed if they engage in dishonest behavior.

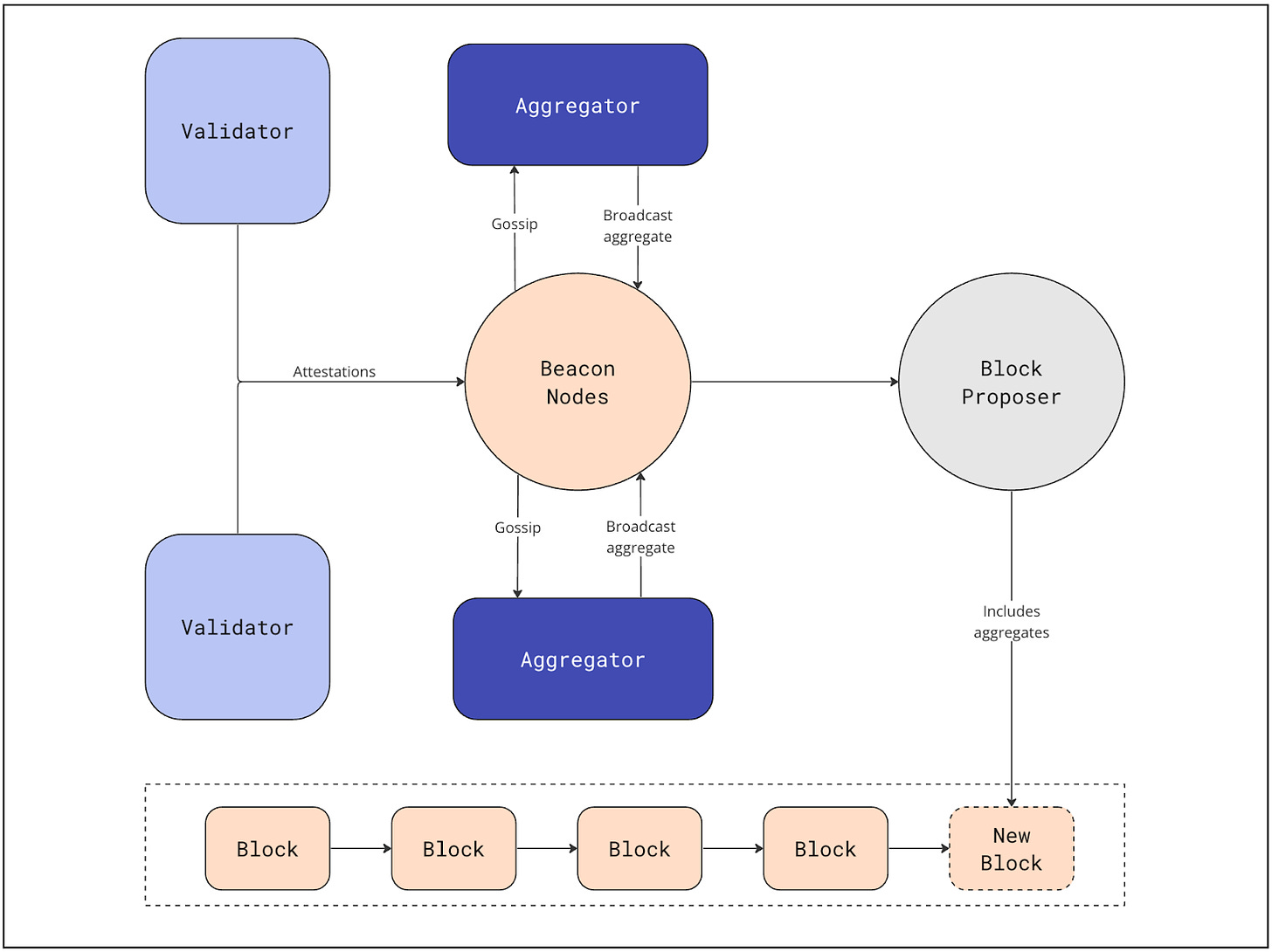

There are several variations and technical differences between validators on different networks, but the mechanics of validation are generally very similar. We can take a look at Ethereum’s PoS mechanism to get a sense of how validation works:

-

To participate as a validator, a user must deposit 32 ETH into the deposit contract and operate three distinct software components: an execution client, a consensus client, and a validator client.

-

Upon depositing their ETH, the user enters an activation queue that regulates the influx of new validators joining the network.

-

Once activated, validators receive new blocks from peers. They re-execute the transactions to verify the proposed changes to Ethereum’s state and check the block signature. The validator then broadcasts an attestation vote in favor of the block on the network.

-

In Ethereum, time is divided into slots (12 seconds) and epochs (32 slots). In each slot, one validator is randomly chosen to propose a block. This validator is responsible for creating a new block and broadcasting it to other nodes on the network.

-

Additionally, in every slot, a committee of validators is randomly selected to vote (‘attest’) on the validity of the proposed block.

PoS rewards

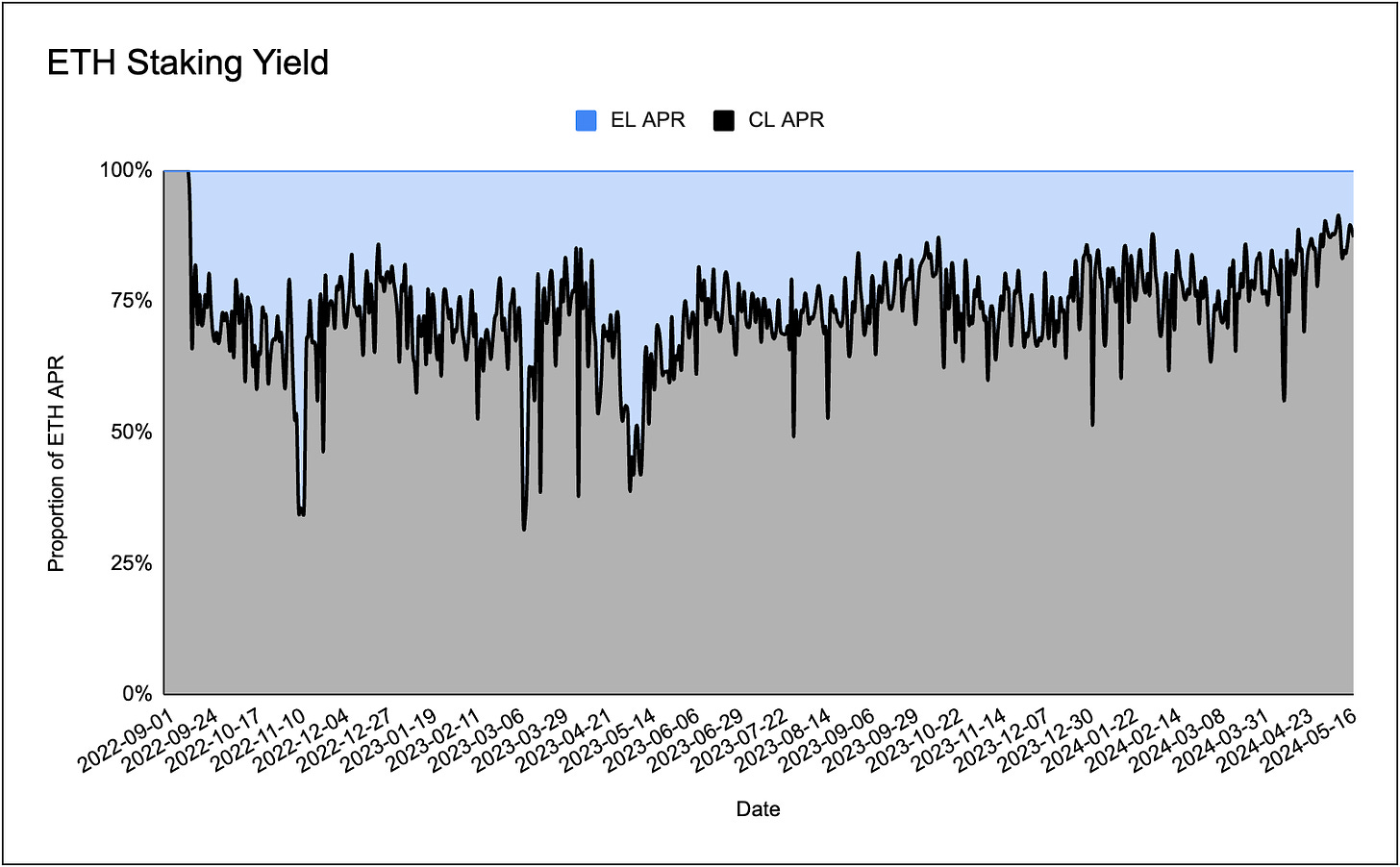

A validator on Ethereum therefore has two main roles: verifying and attesting to new blocks if they are valid, and proposing new blocks when randomly selected. If they complete either of these tasks, they are rewarded with Ether. Rewards accrue from two primary categories: Execution Layer (EL) rewards and Consensus Layer (CL) rewards.

EL rewards include transaction fees, priority fees (tips), and Miner MEV. These rewards constitute approximately 20-30% of a validator’s historical revenue.

Notably, EL rewards are not predefined and can vary significantly. They are only awarded when a validator is selected to propose a block. Given that there are currently over 1 million validators and only 1 block is proposed every 12 seconds, the probability of a single validator being chosen to propose a block is 0.72% per day. Consequently, it takes an average of about 140 days for a validator to be selected for a block proposal. Source.

Consensus layer rewards consist of block proposer rewards and rewards for attestations when selected. These rewards account for approximately 80% of the total reward package historically. Consensus rewards are distributed every epoch, which occurs approximately every 6.4 minutes. The annual protocol issuance on the beacon chain depends on the number of active validators and follows a scaled square root curve. Conversely, the yield earned from the CL rewards follows an inverse square root curve, meaning that as the number of validators on the network increases, the yield decreases.

The total yield a validator earns is then equal to the sum of the execution yield and the consensus yield:

Operational Expenditures

Operating multiple validators on multiple chains requires both technical expertise and a certain amount of Opex. The main costs in running a validator are:

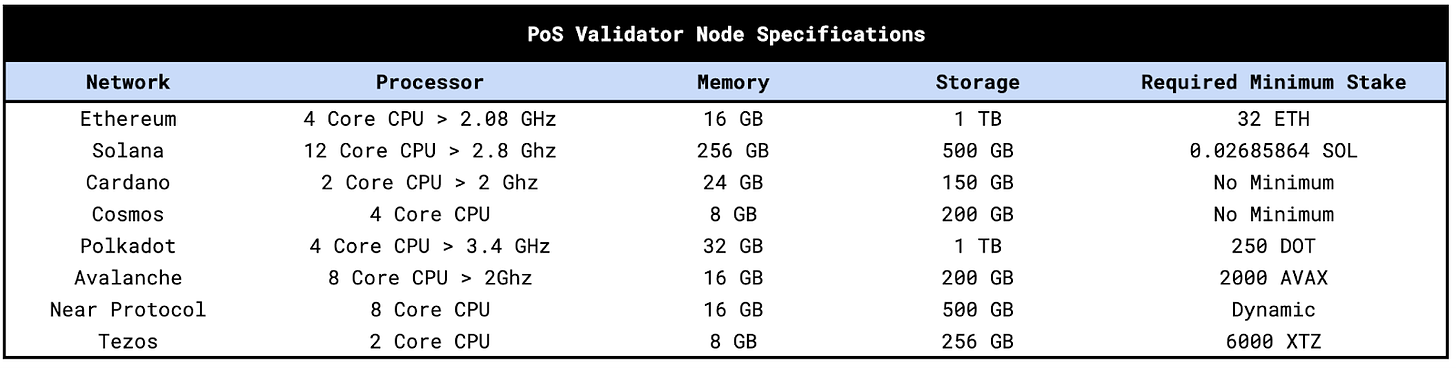

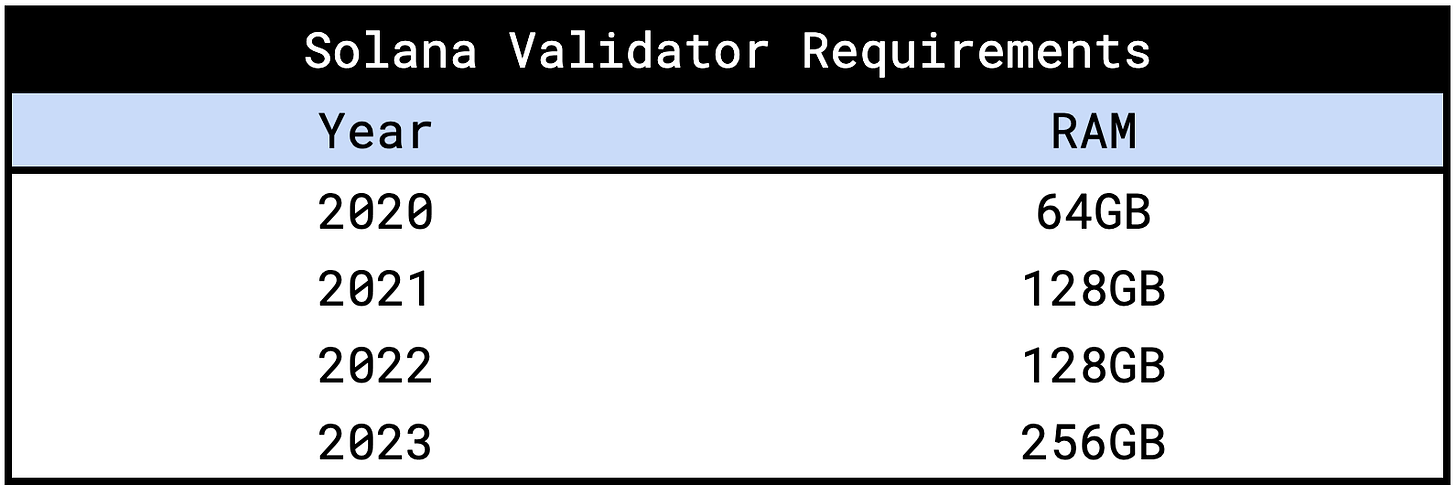

- Hardware - Investing in a reliable computer or server with sufficient resources, along with redundant systems and backups to prevent downtime. The hardware requirements for validation differs per chain, with higher base layer throughput chains requiring higher resources. Via state growth and advancements in tech, these requirements can increase over time:

-

Internet - Maintaining a stable, high-speed internet connection with low latency to ensure constant network connectivity.

-

Electricity - Covering the power consumption of running the hardware 24/7.

-

Maintenance - Regularly updating and maintaining software, including execution, consensus, and validator clients.

-

Security - Implementing robust security measures to protect against hacks and ensure the validator’s integrity.

Whilst the Opex costs are non-trivial, they are orders of magnitudes less than PoW Opex and to the business opportunity for validation services is essentially:

Profit = Staking Rewards - (Opex + Capex)

The name of the game therefore is to scale the amount of stake you are running as a validator through attracting delegations from users.

The State of Validation

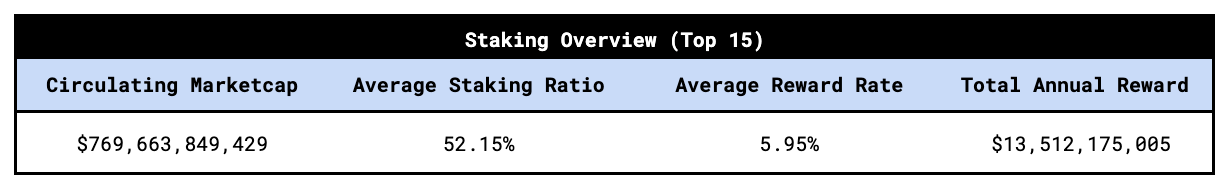

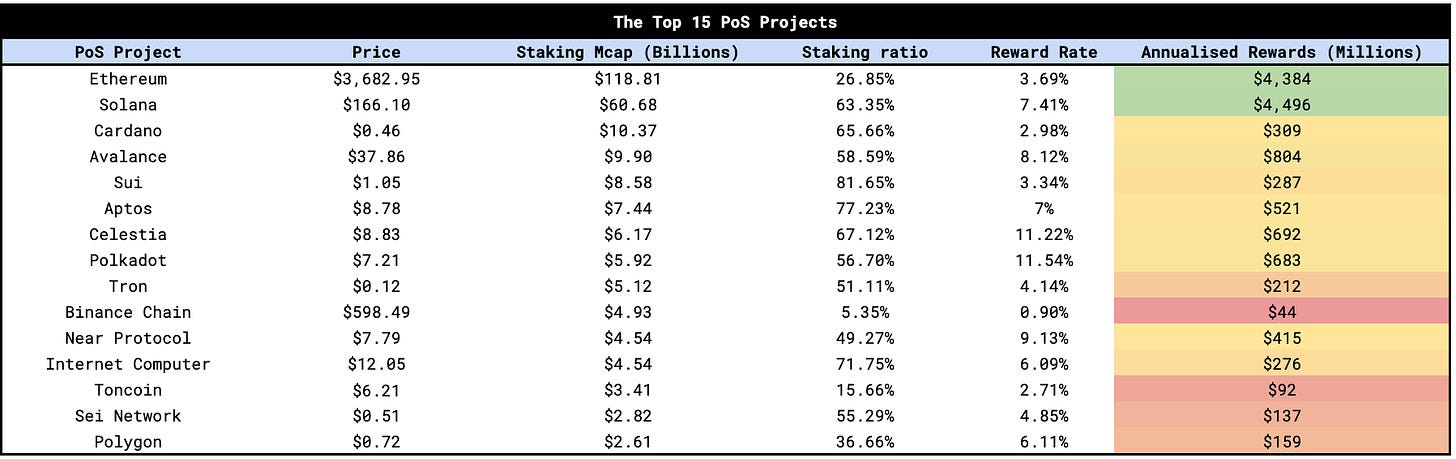

Ethereum, whilst the largest PoS network, is just one of many networks that validators can provide their services to. The top 15 PoS chains have a circulating market cap greater than $769B and generate an estimated $13.5 billion in annual rewards for validators and stakers.

Source: Stakingrewards

With costs remaining relatively constant, the price of PoS assets is linearly correlated to the revenue and thus the profit earned by validators. With crypto prices increasing over the past year, the revenue opportunity has increased linearly with Solana being a standout performer (+682%), producing annualised rewards of $4.5B, greater than Ethereum’s $4.3B in rewards.

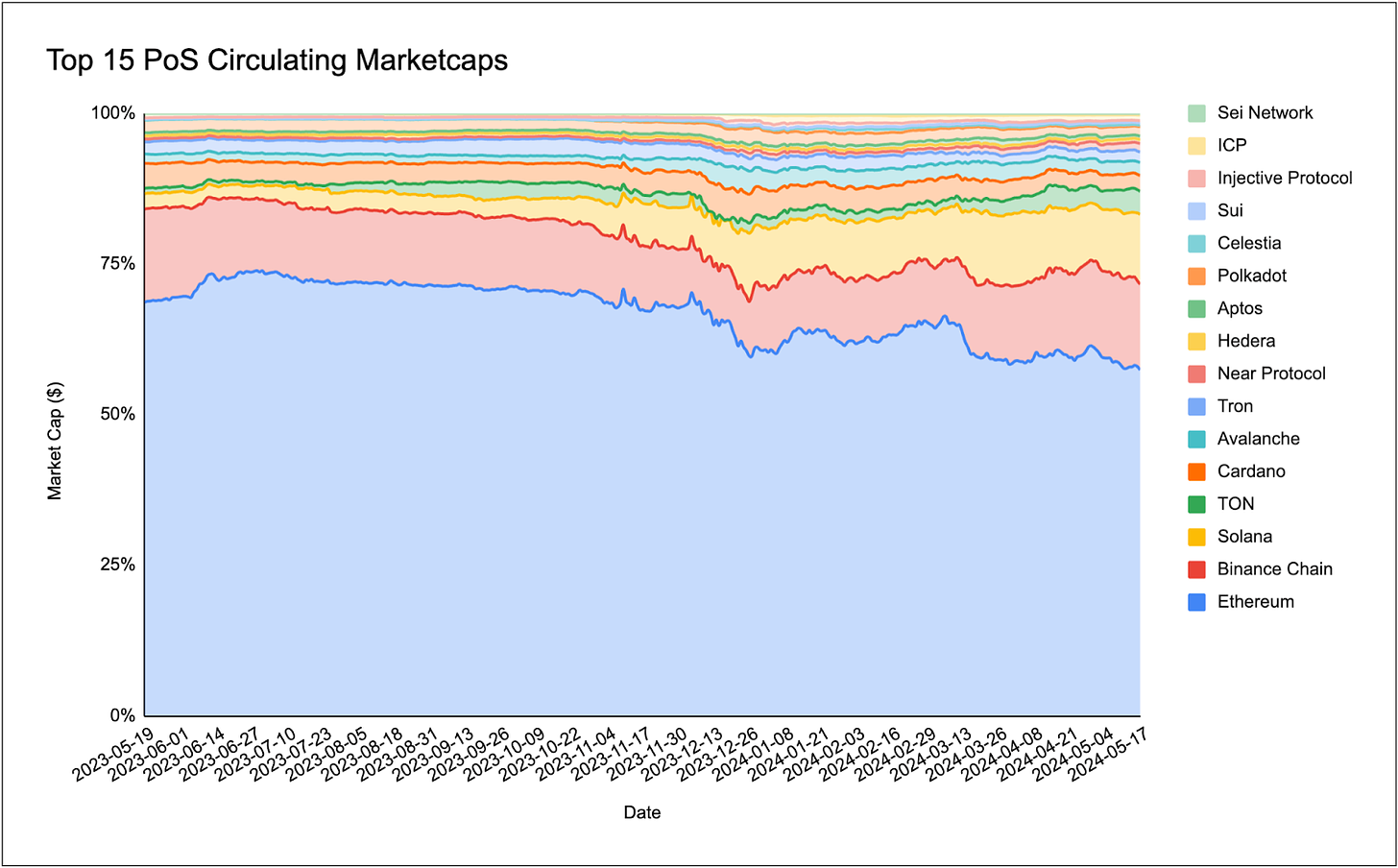

Similarly, the cumulative circulating market cap of these top 15 PoS projects have ballooned, now sitting at 24.3% of the total crypto market capitalization.

Over the past year, Ethereum’s market share has gradually declined, dropping from 69% of the cumulative market cap in May 2023 to 57.4% today. This again reveals the outperformance of Solana, but also highlights the launch of new large PoS networks such as Celestia and Sei:

Liquid Staking

Originating as a solution to the lockup imposed by the Beacon chain pre-merge and as a way to combat the limits of a non-dPoS system, in which users may wish to stake their coins without having to operate the infrastructure required for staking, liquid staking has emerged as a dominant form of staking within the Ethereum ecosystem. Liquid staking provides users with a receipt token representing their claim on the underlying ETH on the Beacon chain, enabling them to utilise this ETH within DeFi.

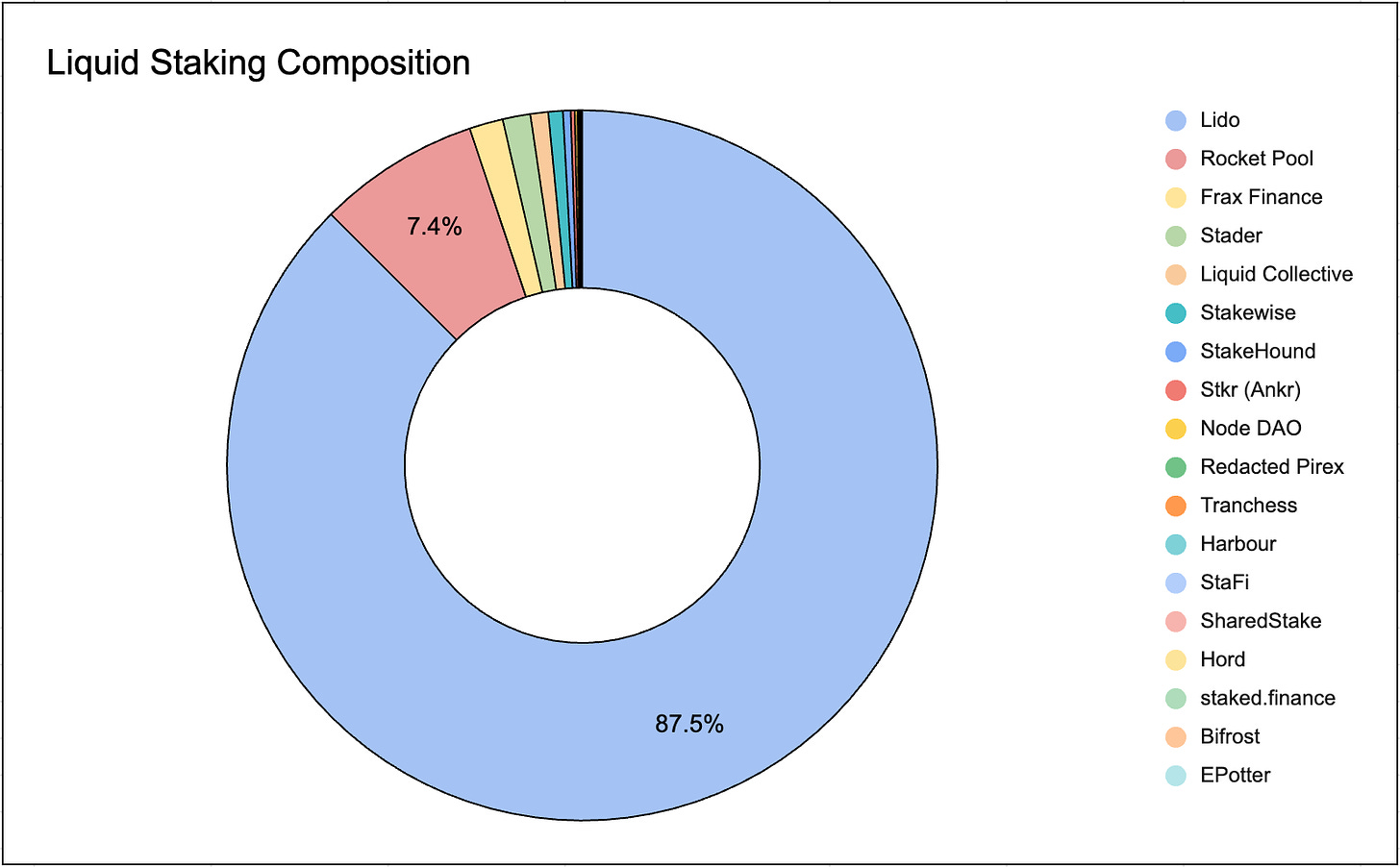

Currently, liquid staking makes up 32.7% of all stake on Ethereum, making it the largest category of staking. Lido is the dominant force here, with an 87.5% market share of the liquid stake market.

It is of note that the unique circumstances of Ethereum’s journey to PoS encouraged a vibrant liquid staking ecosystem and on other chains we don’t see such a penetration of LSTs. For example, Solana has in protocol delegation for stake and we only see a 6.24% LST penetration on the chain, led by Jito’s MEV-enhanced jitoSOL.

Restaking

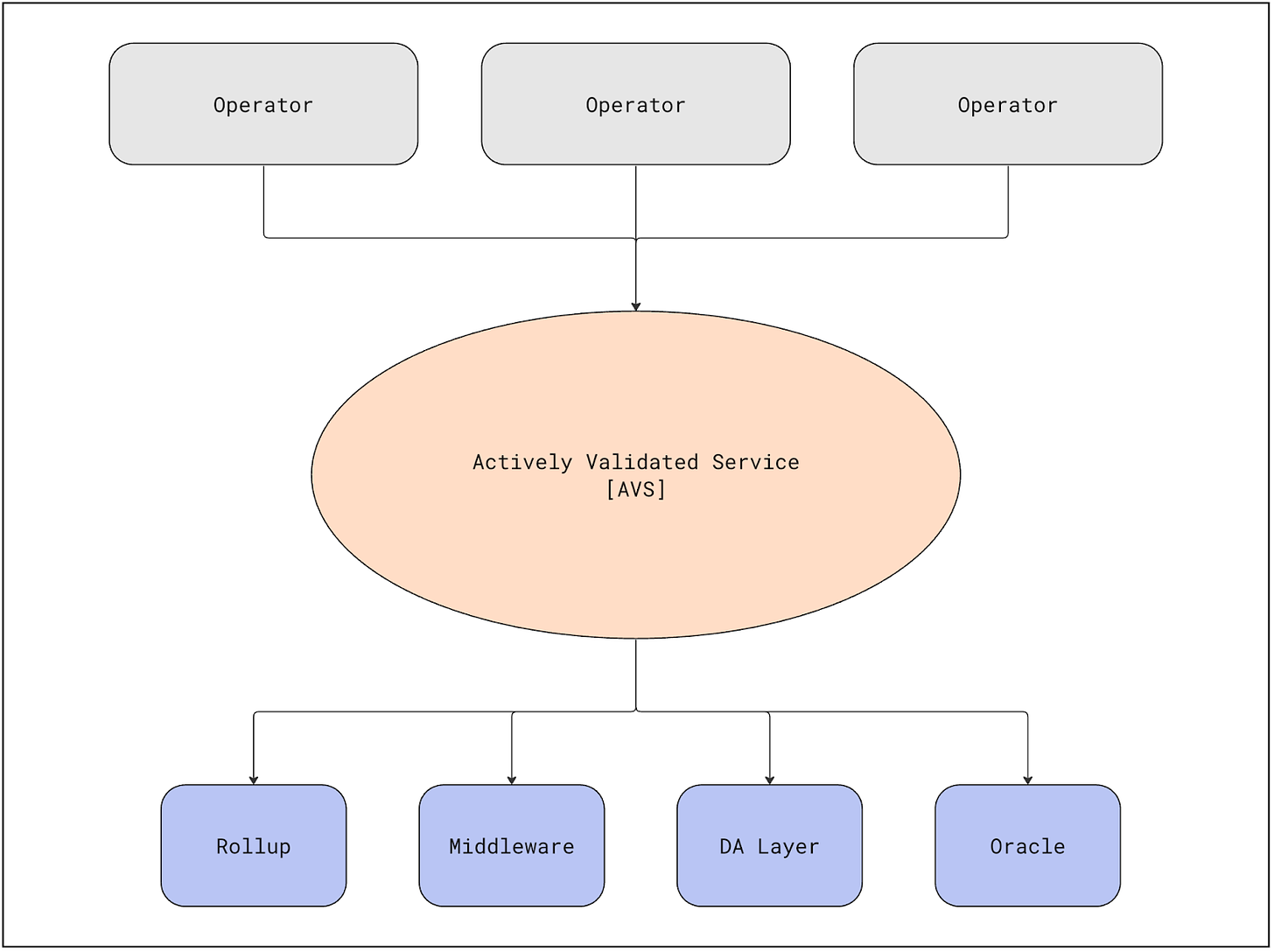

A more recent development and opportunity within the validator space is the advent of restaking services. Restaking is a new primitive in crypto economic security that allows staked assets to be reused to secure not only the underlying blockchain but also additional protocols and applications. This mechanism enables new protocols to utilize a modular technology stack, inheriting security from the underlying blockchain without the need to establish their own validator sets.

By restaking their assets, stakers can earn rewards for securing additional protocols and applications. However, this also introduces additional slashing risks. Both rewards and slashing penalties are determined at the individual protocol or application level, which means that each protocol can set its own parameters for these incentives and penalties. It is the job of the operator to opt-in to additional validation services such as:

- Data Availability Layers - Similar in functionality to Celestia, these layers ensure that data needed by the blockchain is available and accessible.

Source: @hahahash Dune

-

Shared Sequencers - Entities like Espresso Systems that help order and validate transactions across different blockchains.

-

Proof Aggregators - Services that aggregate and verify multiple proofs from various protocols to enhance efficiency and security.

-

Oracles - Systems that provide reliable external data to smart contracts.

Liquid Restaking

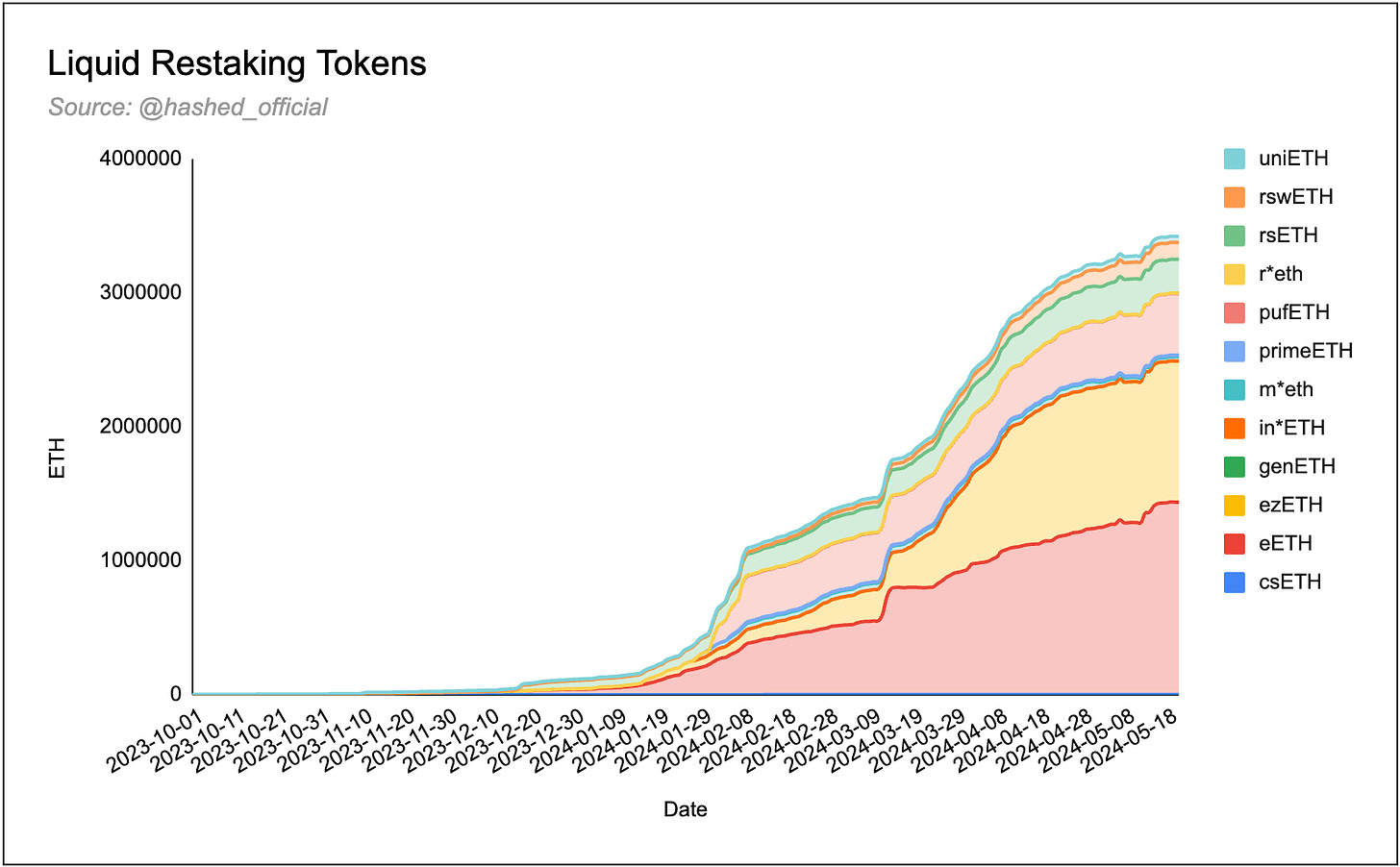

Another development within the staking space is the emergence of liquid re-staking tokens (LRTs), which enable users to have a liquid receipt token representing their claim on the underlying restaked ETH. Since their introduction in late 2023, LRTs have accumulated over 3.4 million ETH ($10.5B).

One of the first LRTs to market was Bedrock’s uniETH, which had a 94% market share of the LRT market in late October, but has since squandered it’s lead to new LRT protocols and incumbent LST protocols launching their own LRT. EtherFi is one such LST protocol, which now has the lion’s share of the LRT market (42.1%) with their eETH product.

ValiDAO’s Value Proposition

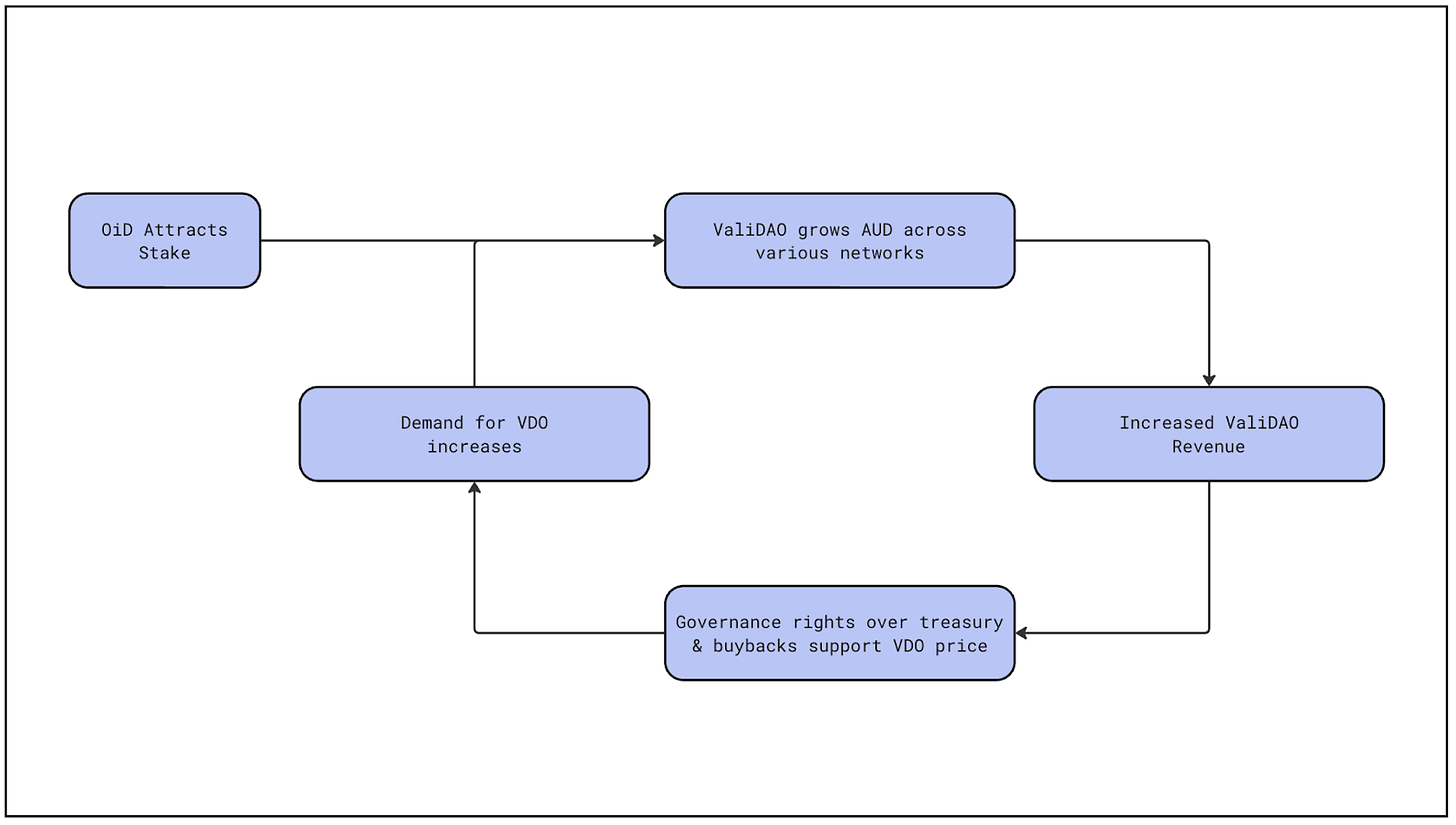

Own and Delegate

The theory behind (O, D) is simple: new chains require security and other infrastructure services which increasingly are offered by specialised staking companies. These services can be operated by individuals as well, but the tendency of newer chains to have smaller validator sets leads to dedicated staking companies dominating these sets due to higherresources of these, allowing them to offer superior uptime and, not least, BD efforts. Because of these tendencies, users on today’s newer chains are generally not able to easily participate in the base consensus layer economy of most newer PoS chains. Here, VDO ownership gives users an easy way to gain exposure, and participate in consensus operations and all that entails, without having to worry about the technical infrastructure.

Additionally, broad ownership of VDO gives ValiDAO an increased likelihood of attracting stake on chains where it operates due to mindshare as well as tokenholder incentives: where there’s an overlap of VDO ownership and L1 token ownership, a user is more likely to stake with a validator entity that they own a part of.

Validator Decentralization

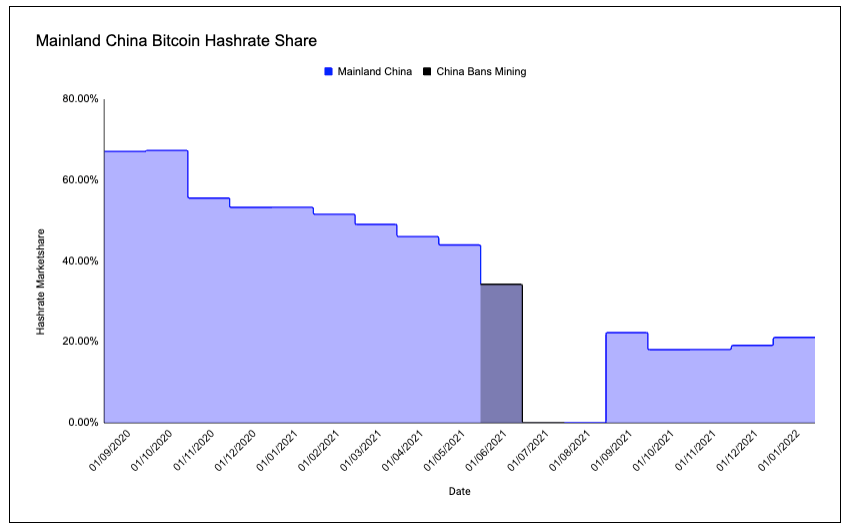

Validators should be geographically distributed to prevent mass censorship by governments or regions and to minimize the impact of wars or natural disasters on the network. China’s ban on Bitcoin mining in 2021 significantly reduced the country’s share of the global hashrate. It also highlights that if a large portion of validators are located in a single country, such as the United States, a ban or shutdown could prevent the network from finalizing blocks.

Many chains are highly centralized in many respects, either through geographically concentrated node locations, or due to stake and ownership distribution. ValiDAO’s value proposition in regards to geographic decentralization is clear: the protocol runs nodes and infrastructure services in underrepresented locations, primarily Iceland.

However, in addition to increasing geographical decentralization, ValiDAO can also be seen as an improved ownership and stake distribution. New chains and networks largely struggle with centralization, and will go to great lengths to either decentralize, or prove that they are decentralized (even if they’re not). The main reasoning behind this push, of decentralizing or attempting to seem decentralized is often rooted in optics and regulation. The more decentralized a chain is, or is perceived to be, the more likely it is to be viewed as a neutral base layer that has a potential for widespread, even institutional adoption.

Helping ownership and stake distribution is therefore one of the key value propositions of ValiDAO. Instead of a small, private firm owning a comparatively significant portion of the network’s supply, which ends up becoming increasingly concentrated due to how stake distribution works on most chains and networks.

For chains like Ethereum, this is less problematic: running infrastructure is expensive, however, theoretically anyone can run a node and become a validator. In contrast, other newer L1s – such as Cosmos L1s – the situation is more limited. Their number of validators is constrained to a certain size due to the consensus mechanism. For example, as of now Cosmos Hub only has 180 validators, which is in the higher end, while Sei has only 39. In situations where the number of validators are limited, including ValiDAO in the validator set can dramatically increase L1 stakeholder distribution, given that ValiDAO is co-owned by thousands of users – a boon to the actual (and perceived) decentralization of the chain.

Product Offering

Overview

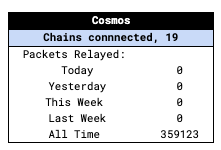

The core business model of ValiDAO is to operate consensus services – validators – on (d)PoS chains. Additionally, ValiDAO operates supportive services such as RPC and IBC relaying infrastructure.

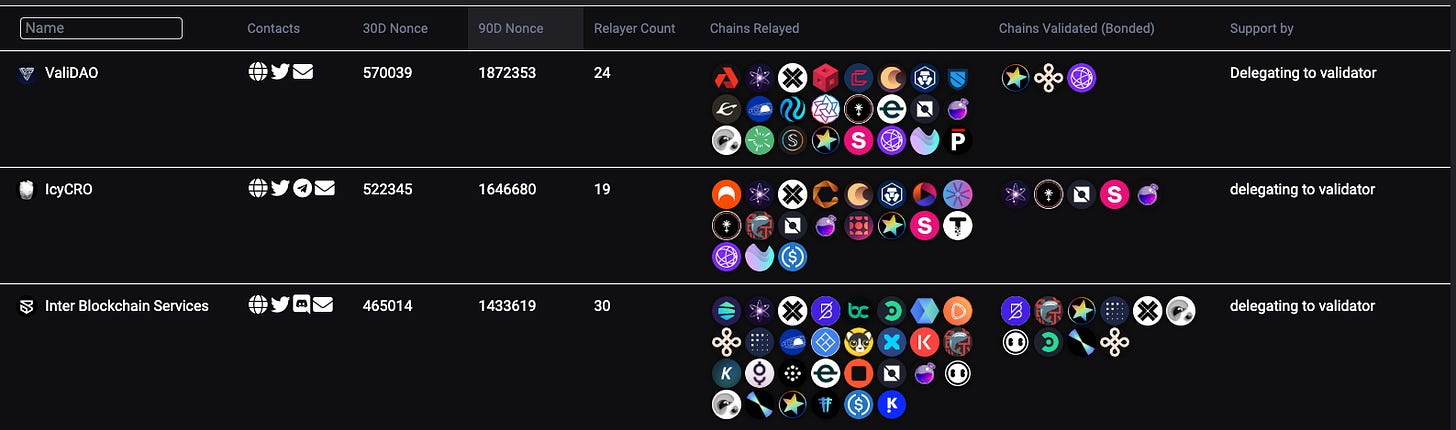

Currently, ValiDAO is the #1 IBC relayer in all of cosmos.

Below is an outline of the 3 services ValiDAO offers as well as which chains they are offered on:

Brief Summary of Main Networks

Dymension: Staking

Dymension is a blockchain infrastructure project that focuses on enabling modular blockchain networks, which are referred to as ‘RollApps’. These RollApps are designed to be interoperable and scalable, allowing developers to create custom blockchain solutions that can communicate and transact with each other seamlessly.

Celestia: Staking, RPC, and IBC Relayer

Celestia is a blockchain infrastructure project that provides a modular consensus and data availability layer to other blockchains. Its main innovation is separating the consensus and data availability functions from the execution layer, this allows developers to build custom scalable blockchains that use Celestia for secure consensus and data availability.

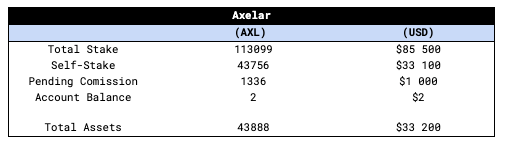

Axelar: Staking, RPC, and IBC Relayer

Axelar is a blockchain infrastructure project that focuses on providing secure cross-chain communication and interoperability. This allows developers to build dApps that can interact with multiple blockchains, facilitating the transfer of information and assets.

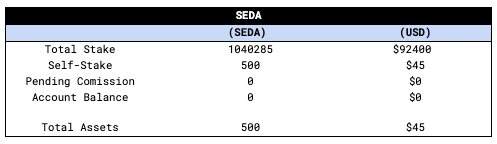

Seda: Staking

Seda offers an intent based modular data layer that goes beyond the typical definition of an oracle, it functions as a data transmission and computation network designed to provide a permissionless environment for developers to deploy data feeds. The network implements a fully modular interface, this allows developers to specify which data feeds to fetch and how to use the data for computations.

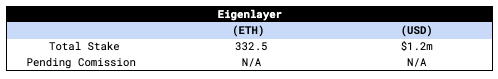

Eigenlayer: Staking

Eigenlayer pioneered the innovative concept that is restaking, it’s the practice of using staked Ethereum to provide security to other networks. This makes the barriers to spinning up a new network negligible as bootstrapping a validator set is no longer an arduous endeavour.

Akash: RPC and IBC Relayer

Akash is a decentralised cloud computing platform designed to provide a more flexible, cost-effective, and censorship resistant alternative to traditional cloud services. Through the use of a peer-to-peer network, Akash allows users to rent out their idle computing resources, creating a decentralised marketplace for cloud infrastructure.

We have included a full overview of ValiDAO’s product offering in the appendix.

Protocol Mechanics

ValiDAO falls under the category of decentralised staking infrastructure. A token holder delegates their tokens to a validator and collects the yield less a management fee. However, unlike centralised staking infrastructure providers, the delegator can own a portion of the protocol which manages the stake.

Here’s a high level overview of how the protocol works:

-

A token holder opens the ValiDAO webpage and picks a chain to secure, they then delegate their tokens to ValiDAO’s validator. This is traditional staking in the sense that there is no liquid staking token returned as a receipt.

-

As per the usual process, the ValiDAO validators secure the network and earn block rewards for doing so. ValiDAO takes a cut of these rewards and passes the bulk back to the delegator.

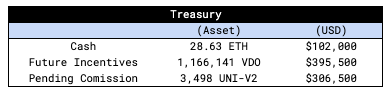

ValiDAO Treasury

The treasury was seeded with 10% of $VDO tokens from the TGE and accrues value from:

-

Validator commission

-

Uniswap VDO/ETH pool fees

The ValiDAO treasury funds:

-

Operational expenses (hardware costs, salaries, legal expenses)

-

Native token buybacks

-

Token incentives

(O, D) – Own and Delegate as the New (3, 3)

The ValiDAO model can be compared to a cooperative: a massively co-owned entity whose broad ownership (network effects) strengthens its ability to be competitive in attracting stake, growing its assets under management, which in turns makes it more attractive for speculators and in turn newcomers.

The game theory behind the mechanism design is worth understanding as it’s ValiDAO’s differentiating factor. In order to do so, we have to think in terms of incentive structure and consider which incentives are facing a token holder who is deciding between which staking infrastructure provider to delegate toward. Assuming there is a choice between two identical staking service providers, the only differentiating factor is who the rewards accrue to – a private company, or a public protocol. These are both for profit entities, the differentiator is who is entitled to the profit.

When staking with ValiDAO, the delegator earns staking rewards as they normally would, as well as token incentives in the form of the native token $VDO in cases where delegations are incentivized. $VDO confers voting rights over the DAO and its growing stake in many different networks.

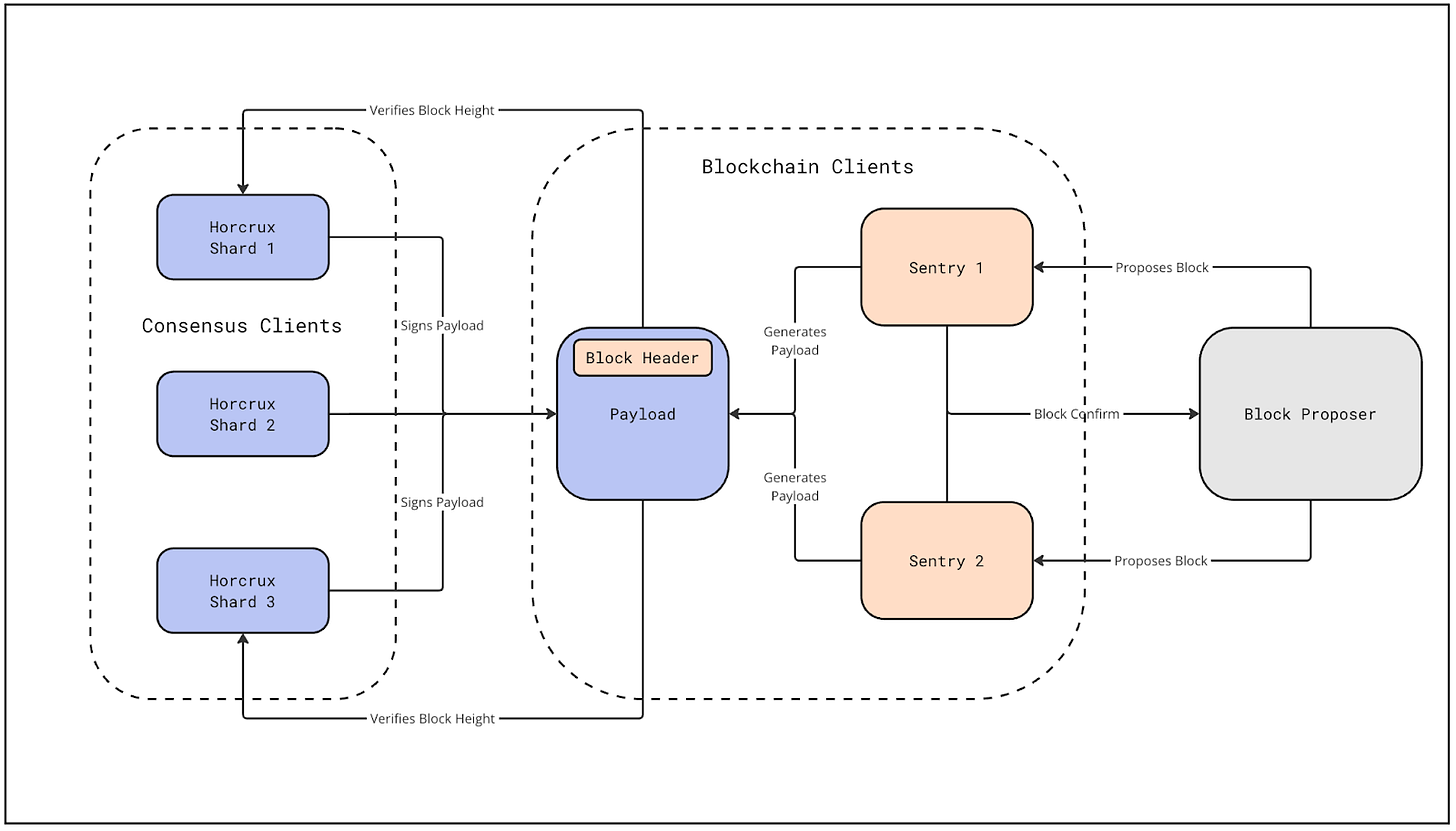

Security Measures

ValiDAO employs a robust security policy to ensure both the reliability and integrity of its validator operations. In the case of Tendermint-based chains (which are currently the majority), the key security measure is the use of Multi-Party Computation (MPC) which enhances the security of the signer keys. Here, Horcrux, a threshold tendermint remote signer, is used. Under this setup, a consensus private key is split into 3 separate shards, which are then distributed across different servers that are located in different geographical locations and on different providers.

In order to sign and confirm a block, a minimum of 2 out of 3 keys is needed. This enhances fault tolerance and minimises the risk of system outages affecting the signing process. Furthermore, such a remote signing setup is a measure that protects against accidental equivocation

ValiDAO ensures high standards of decentralisation: they operate multiple blockchain nodes – known as sentries – which are deployed in regions separate from the signing servers. This ensures continuous operations, even if one node goes offline.

Validators are rewarded with the usual block rewards. In order to secure the rewards, ValiDAO keys are stored offline, ensuring that rewards are safe from a potential system breach. Moreover, ValiDAO implements a slashing insurance fund, which protects delegators from a financial loss in the rare case of a slashing event.

Roadmap

The primary goal of ValiDAO is to continue to attract delegations and grow the assets under delegation (AUD) and thus the revenue the DAO earns from validation services. This typically means most of the work is done behind the scenes via cultivating relationships with PoS chain teams or large clients looking to delegate assets. Unique to ValiDAO is the joint contribution of all DAO members to be vocal and garner partnerships, deals and delegators for the DAO. We have seen this in action with DAO members reaching out to founders or team members they know to onboard ValiDAO as a validator. All these activities seek to grow ValiDAO AUD and this is the core goal on ValiDAOs roadmap. That said, there are a number of near term initiatives the team have been focussed on:

-

DAO constitution vote - Getting the constitution voted on and passed. This Constitution provides an overview of the governance framework for ValiDAO and VDO token holders, who govern ValiDAO. It will lay the ground rules, but still remain open to be amended through VIPs.

-

Council Instantiated - As part of the constitution, a lot of decision-making power will be delegated to a council, comprised of 5-7 individuals, as well as the leadership team. This will give the DAO the agility to move quickly and make key decisions in the interest of the DAO. Selecting these council members and putting processes in place to enable them to run the DAO is a short term goal.

-

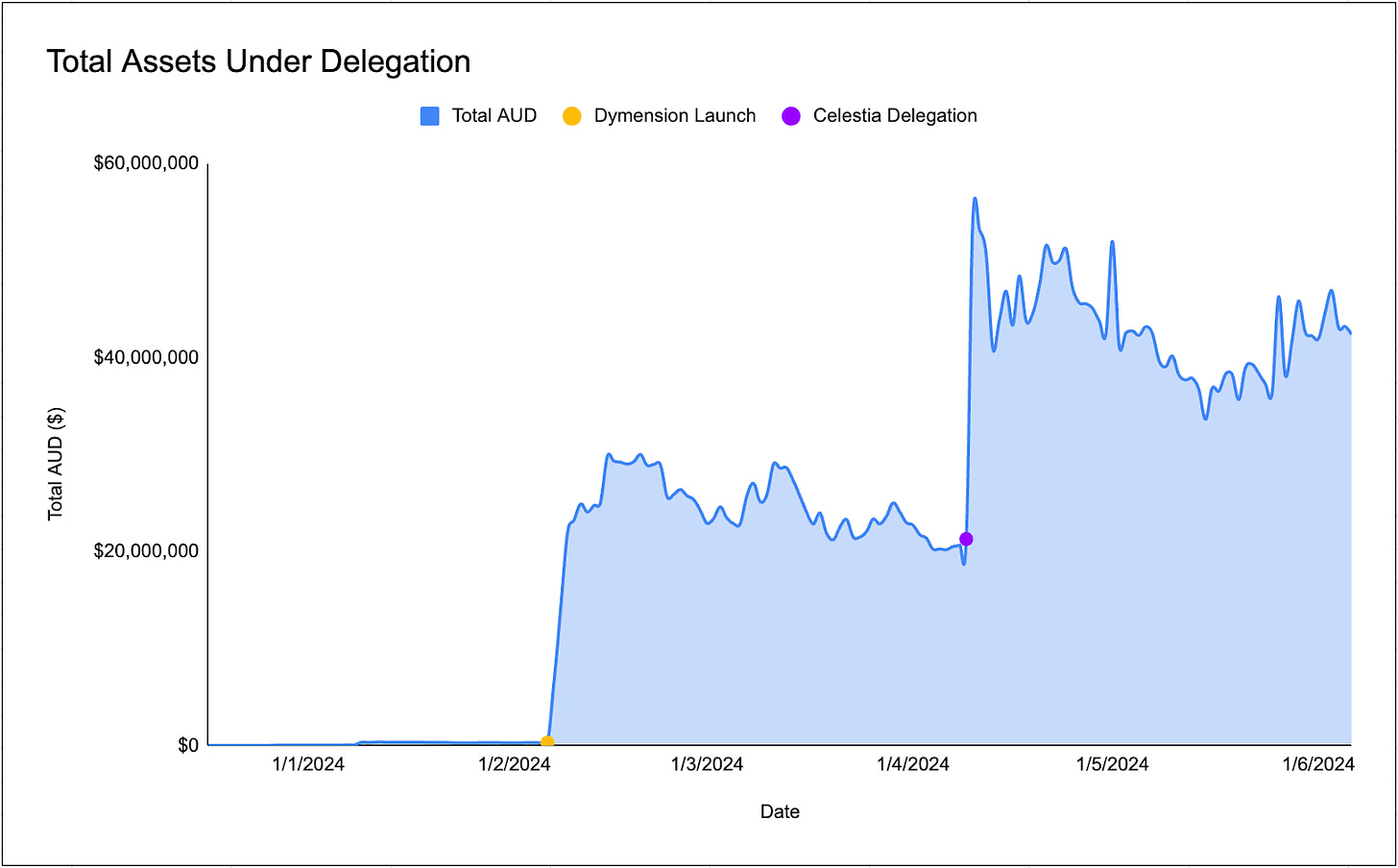

Airdrop Completion - ValiDAO attracted a lot of DAO members, attention and mindshare during their successful community acquisition via airdrop during the launch of the Dymension network. Delegators of the DYM token to ValiDAO were eligible to a VDO airdrop with tokens from the treasury, however, since the legal framework of the DAO had not been put in place the airdrop has been delayed. With the legal formation of the DAO now in place, completing the airdrop is a core goal of ValiDAO.

As mentioned, the longer term and persistent goals of the DAO are to continue operations as normal:

-

Joining and continuing validating new testnets, including but not limited to, Monad, Initia, Unicorn, Berachain and Babylon.

-

Growing AUD by reaching out to specific clients (funds, HNIs).

-

Targeted campaigns to incentivize delegations on new chain launches similarly to Dymension.

Catalysts

New Chains and Delegations

One of the key catalysts behind ValiDAO is the proliferation of the modular thesis. As more rollups, chains, AVSs and other infrastructure launch, there will be increased demand for validation and infrastructure services. ValiDAO should place itself at the forefront of modularity, aiming to validate and provide infrastructure to as many newly launched chains, beginning at testnet and devnet stages, which requires strong BD efforts. The team has thus far managed to sustain relatively economically viable validation and infrastructure services to nearly ten chains. As rollup-based infrastructure projects, like Initia, Movement and Sovereign Labs, launch and gain popularity and we potentially see increased an number of rollups in the ecosystem, both generalized and app-specific, the opportunities for ValiDAO will increase drastically.

In addition to the modular thesis playing out and being beneficial to ValiDAO, the protocol can also benefit from delegations. As we’ve seen, ValiDAO received a sizable delegation from the Celestia foundation. If ValiDAO receives further delegations from other large infrastructure projects, it would be highly beneficial given that it would increase the revenue of the project drastically. Given that ValiDAO is a publicly-owned validator and infrastructure services protocol, it has an edge compared to other grant applications, who tend to be private validators and individuals, and not publicly-owned.

Future Airdrops

ValiDAO’s airdrop campaign for DYM stakers was very successful. Despite the snapshot being taken months ago, staked DYM has been relatively sticky, with 3.25M (worth approximately $7M USD) still being staked with ValiDAO. Future campaigns, where a similar “stake-for-airdrop” strategy is employed, could similarly lead to an increased amount of staked tokens in the future, especially as more PoS networks launch.

One key potential catalyst here is that increased stake delegated to ValiDAO improves the protocol’s revenue, based on the commission that it takes (in the case of Dymension, the protocol takes 5% of rewards on 3.25M DYM). This revenue can be used to deploy validator and infrastructure services on other networks, can be airdropped to VDO holders, or can be used for token buybacks.

Future Airdrops

Recently, VIP #1: Token Buyback Mechanism was posted on the forum highlighting a revamp of the value accrual mechanism of VDO. Below is a short summary of the proposal.

VIP #1: Token Buyback Mechanism

-

Buyback Mechanism: On a monthly basis, the DAO will use 25% of its accrued validator rewards to repurchase $VDO tokens on the open market. These repurchased tokens will be sent to the DAO’s multi-sig treasury wallet.

-

ETH Conversion: The DAO will also convert 15% of its accrued validator rewards into ETH on the same monthly schedule. This ETH will also be held in the DAO’s multi-sig treasury.

-

Remaining Rewards: The remaining 60% of accrued validator rewards will be held by the DAO, either in the original token form or potentially converted to more stable assets as needed.

-

Treasury Management: The proposal aims to establish a framework for the DAO to actively manage its treasury assets, including the repurchased $VDO tokens and the ETH holdings. This could include using the tokens for incentive programs or burning them in the future.

-

Rationale: The goal is to provide economic incentives for $VDO token holders to participate in governance and support the growth of the DAO, by directing a portion of validator revenue towards token buybacks.

Although buybacks are not the most efficient form of value accrual, the implementation of this proposal would greatly improve VDO’s utility. At it’s current stage, VDO is a governance token, which doesn’t directly benefit from the protocol’s revenues and financials.

Onboarding Main Chains

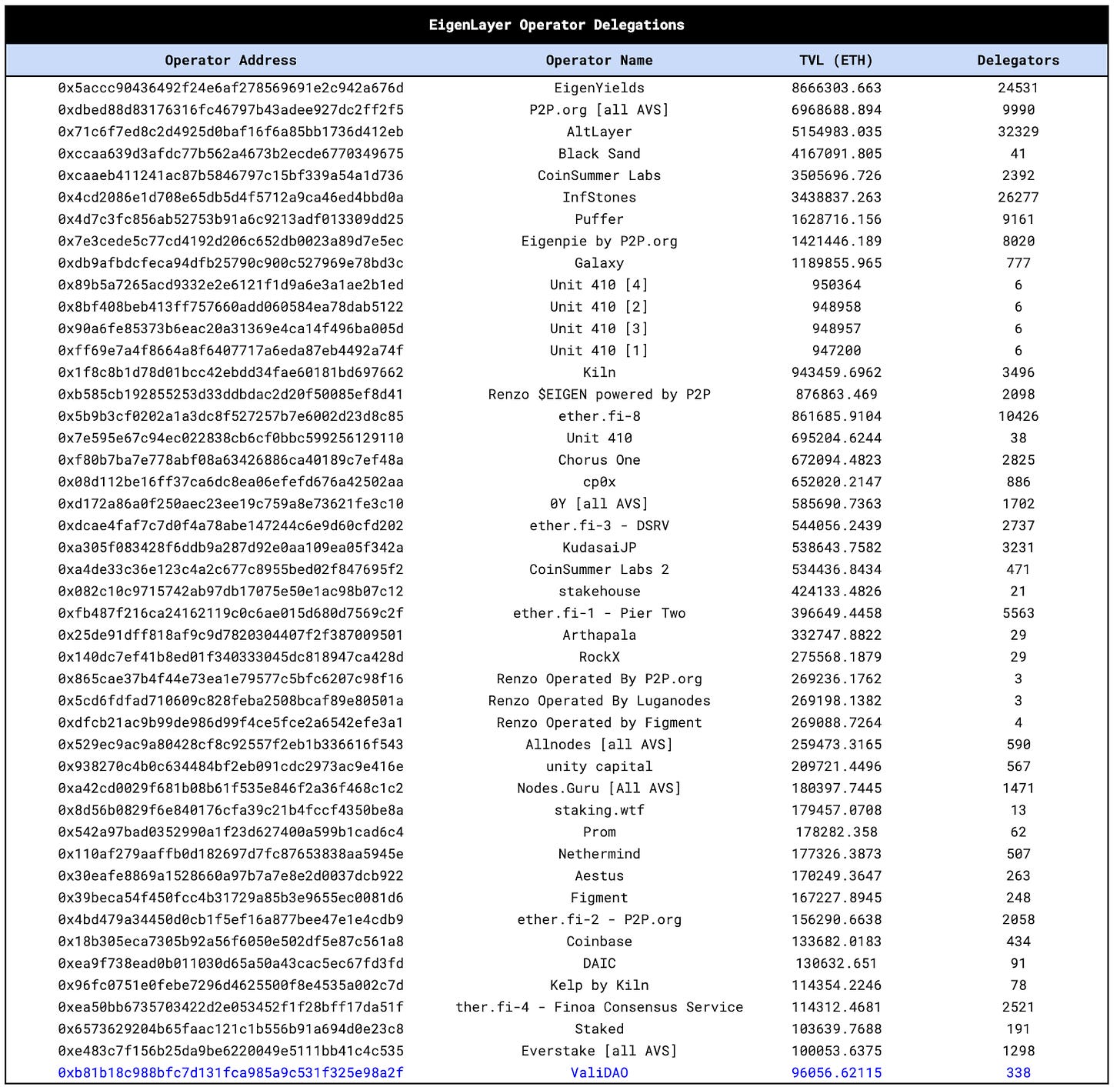

ValiDAO is currently focused on chains with dPoS, with extensive experience in the Cosmos ecosystem. However, we see a significant opportunity for ValiDAO to expand to larger chains in various ways. Solana is a prime candidate for this expansion, and we believe ValiDAO should apply for a delegation from the Solana Foundation to meet the minimum stake requirement. Although Ethereum is not a dPoS chain, there is potential for ValiDAO to gather stake through their operations with staking protocols such as Eigenlayer (of which they are an operator) and with LRTs through protocols like Mellow. The ultimate goal of entering the Ethereum ecosystem would be joining the Lido operating node set, where the stake for each node operator (NO) is targeted to be 287,296 ETH ($1.02 billion).

Token Economics

Token Utility

The VDO token grants holders access to the DAO, where they can vote on a number of key configurations of the protocol and the direction of the DAO. For example, users can vote on:

-

The commission fees for nodes.

-

The LP tax fees.

-

Proposals for the addition of new blockchain networks.

-

Proposals for the removal of validating services on networks.

-

Grant distribution.

-

Distribution of fees.

On top of granting holders admission into the DAO, the VDO token accrues value via treasury buybacks from the profits earned through validation rewards. We will analyse these buybacks and how they can scale in the valuation section later. Finally, a utility for holders is the opportunity to own a stake in the business they use daily for staking their assets. Instead of paying Coinbase a 25% fee or Lido a 10% fee for staking their crypto assets, they can delegate their assets with ValiDAO and share in the rewards generated from their delegated assets.

Token Supply

On the 14th of December 2023, the VDO token was launched with a fair distribution model, avoiding VC funding and private rounds entirely, instead opting to allocate 90% of the token supply to the community and partnerships.

At launch, 80% of the VDO token supply was paired with 1 ETH in a UniV2 pool and a 5% buy tax and 5% sell tax were applied as a way to bootstrap the treasury without taking on external funding. This trading fee was over time lowered to the current 3%.

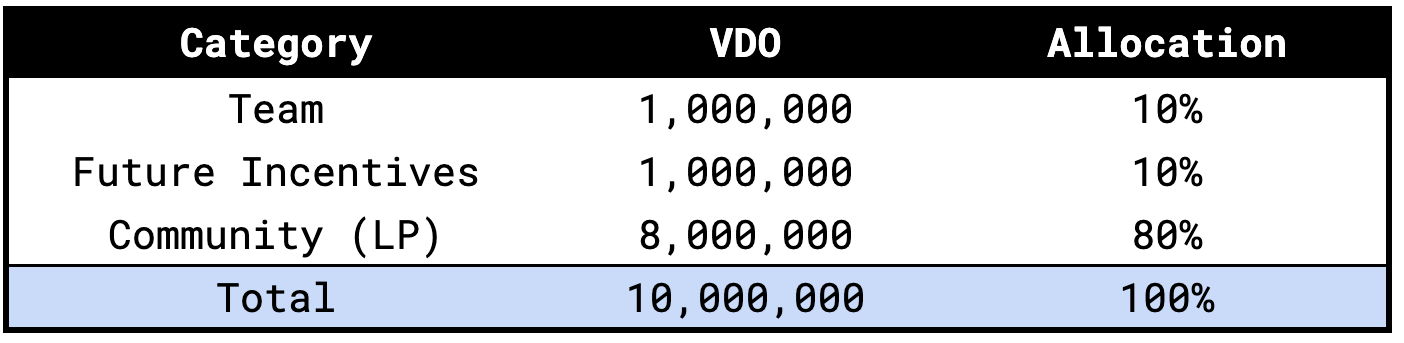

The remaining token supply was allocated as follows:

-

10% to the team, with varying vesting schedules.

-

10% to future incentives, which have been earmarked to strategically acquire stake on certain mainnet chains. It will also be used as compensation to early contributors. An example of this was the acquisition of DYM delegations via a VDO airdrop.

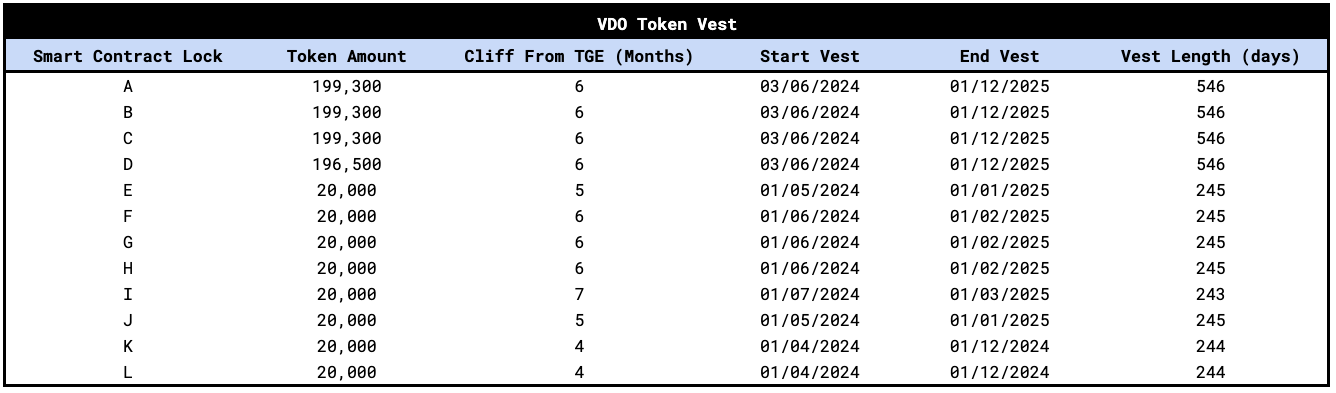

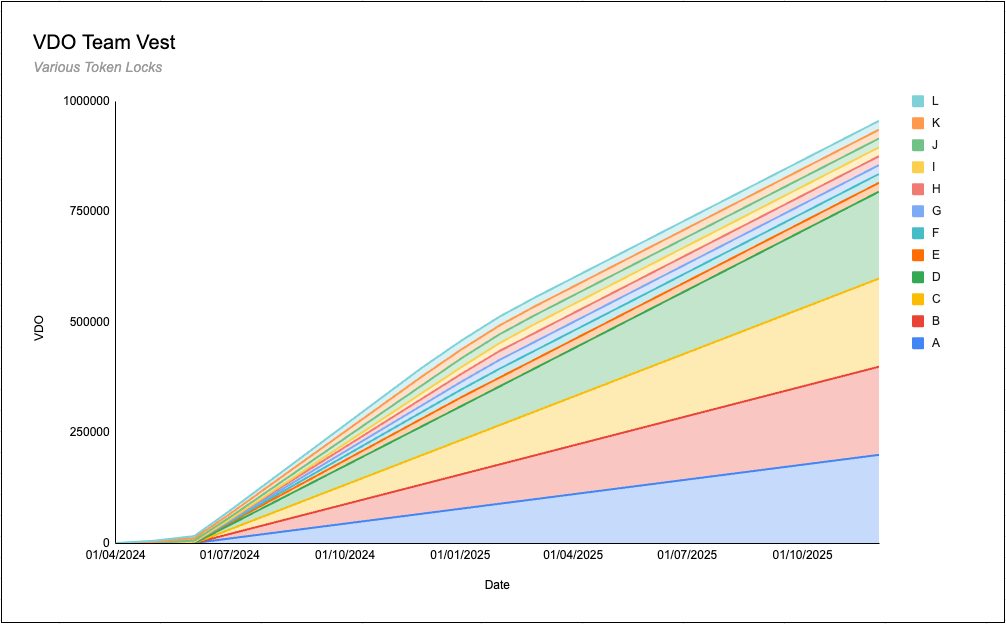

Emissions

Of the 1,000,000 VDO team allocation, 950,630 VDO is locked in Unicrypt vesting contracts with a vesting period between April 1st 2024 and Dec 1st 2025 . The breakdown of those vesting tokens are as follows:

The majority of these tokens start vesting on June 6th 2024 and take 18 months to fully vest. You can verify all the locked tokens and their emission schedule here. To do so, insert the VDO token contract and click ‘view locks’.

Token Demand

Demand for the VDO token comes from delegators wishing to vote on the direction of the DAO, speculation and from the treasury buybacks with profits. To date, the treasury has bought back 373,582.03 VDO tokens (3.74% of supply) from the open market, which they now hold in the treasury. In the valuation section we will analyse this buyback mechanism.

Valuation

Buyback Analysis

Utilising on-chain data, we can analyse the treasury buybacks of the VDO token. These buybacks are funded from the revenues of the protocol from validation services. Since the VDO Uniswap V2 LP has trading fees enabled, these fees also contribute to the buybacks.

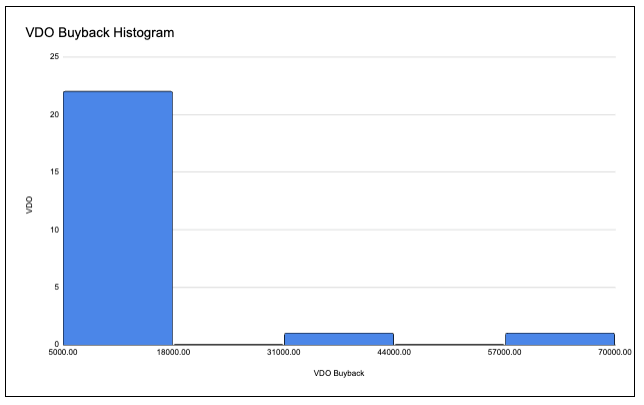

The data is as follows:

The buyback mechanism has acquired 373,582.03 VDO tokens with a cost basis of $0.65 and a total spend of $242,324.78.

The buybacks are currently discretionary, requiring the multisig signers to approve a swap. In the future there are plans to propose a % of revenue to be bought back at regular intervals.

As we can see from the cumulative buybacks, there has been a steady accumulation of VDO off the open market, with the majority of buyback swaps falling within the 5,000 - 18,000 VDO range:

The buyback program has expended $242,324 to acquire VDO over the first 151 days of trading, averaging $1,604 per day. Notably, the majority of these buybacks took place before ValiDAO received its 3 million TIA delegation. Therefore, any annualized figures based on these initial 151 days of trading are likely to be lower.

However, if we annualize these buyback figures we get an annualised buyback of $586,153. If we assume no slippage on buybacks and the VDO price remaining constant at $0.53, this yearly buyback will take 11.05% of the VDO supply off the market.

Revenue Analysis

As a brief reminder, ValiDAO makes revenue via providing blockchain infrastructure services with the majority of income originating from validating PoS chains. The revenue ValiDAO earns therefore linearly scales with:

-

The Assets under delegation (AUD)

-

The Price of the underlying PoS asset

-

The PoS yield (%)

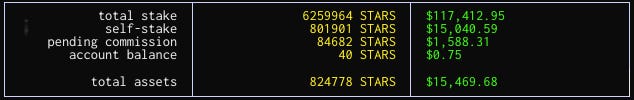

Over the past six months, ValiDAO has impressively secured $42 million in delegations for their validation services. The majority of these assets originate from delegations by the Celestia Foundation and Dymension Chain delegators. Any delegation that ValiDAO receives earns the chain’s native staking yield less ValiDAO’s compensation for running the infrastructure. ValiDAO’s take rate is usually between 5-7% and using these take rates per chain, we can get a figure for ValiDAO annualized revenue over the past 6 months:

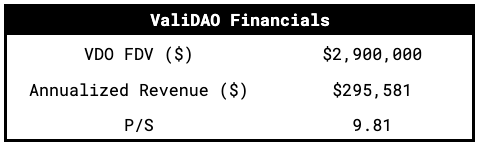

Currently ValiDAO is doing ~$300,000 in annualised revenue, meaning at the current fully diluted valuation it is trading at a 9.81 price to sales ratio.

Trading fees

Whilst the AUD and annualized revenue that ValiDAO generates is impressive for a 6 month old business, we are most excited about the future of ValiDAO and their ability to grow revenue linearly with delegations. We can model out what this growth will mean for ValiDAO:

Firstly, we must look at ValiDAOs current revenue statistics. The average PoS yield on chains that ValiDAO validates for is 5.32%. Celestia, which accounts for 74.65% of AUD currently has a yield of 10.7%, meaning the average stake weighted PoS yield is slightly higher at 10.54%. Further, when taking a look at the average PoS yield of the top 15 chains as we did earlier, we see the average is 5.95%.

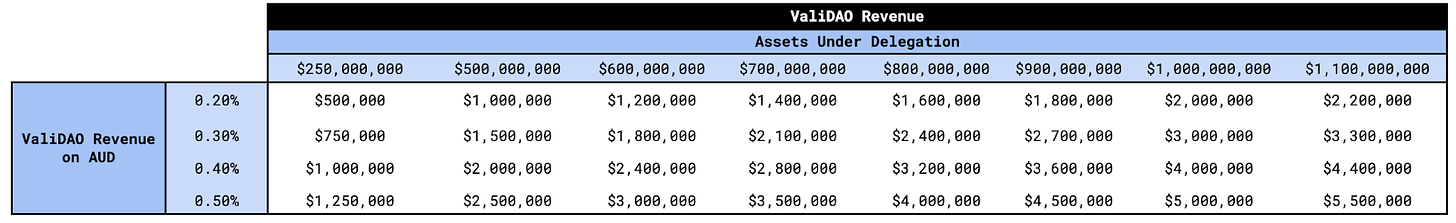

ValiDAO takes between 5-10% of this yield as the take rate. If we take a PoS yield of 5.5% and a take rate of 5%, we can calculate a number which allows us to estimate the revenue ValiDAO would earn from onboarding new chains and from increasing AUD. This ‘ValiDAO Revenue on AUD’ number will therefore vary with take rate and PoS yields.

We can sensitise these figures to work out ValiDAO revenue at varying AUD’s and ‘Revenue on AUD’ figures (takes rates * PoS yields):

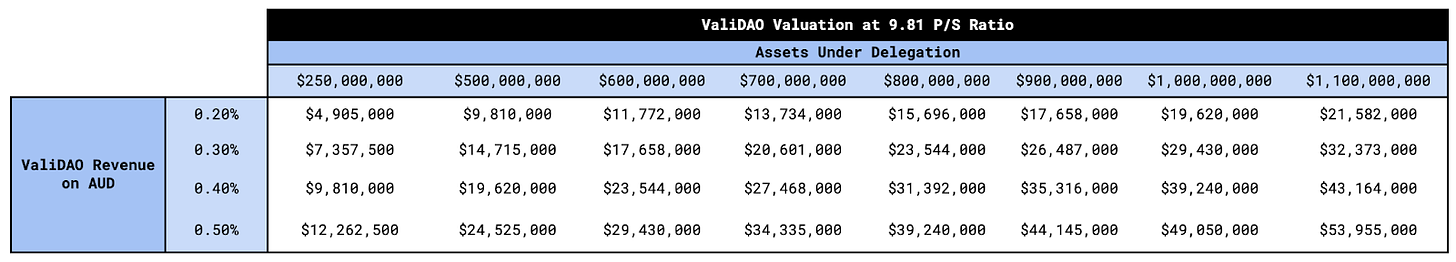

Taking these revenues at various AUD’s we can calculate the valuation at which the VDO token could trade at. As we mentioned, the current P/S ratio is 9.81, even at these depressed levels. Sensitising these valuations we get the following:

If ValiDAO can increase their AUD to $1 billion through new chain launches, crypto price appreciation, and attracting delegations from high-net-worth individuals (HNIs) and funds, whilst generating revenue equal to 0.4% of their AUD, this growth could position the VDO token at a FDV of $39.24 million, reflecting a P/S ratio of 9.81, consistent with the current P/S ratio.

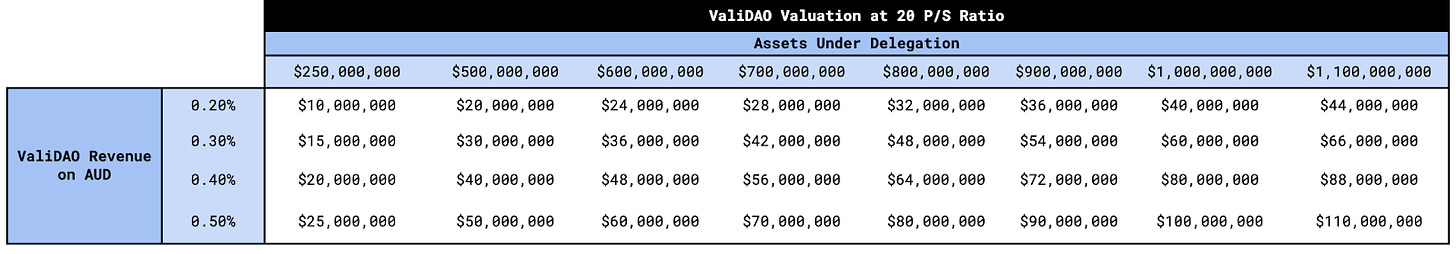

As we know, crypto markets don’t exactly trade on fundamentals and its expected that valuations undergo large expansions and compressions over and under ‘fair value’. With this in mind, we have sensitised the valuation of VDO, this time using a P/S ratio of 20. Amongst the staking sector, this P/S is common with Lido trading at a 14.27 P/S and Stader trading at a 44.47 P/S:

Comparative Analysis

Validating a network is the core economic activity, that being said, there are many businesses built around validating a network. The primary value proposition these businesses provide is abstracting away all the complexities associated with network validation. These complexities can be broken down as follows:

-

Technical Expertise – infrastructure setup and software configuration

-

Security – private key management and protection against attacks

-

Maintenance and Monitoring – ensuring uptime and up to date software

-

Economic Complexities – minimum stake required and reward management

-

Compliance and Legal Complexities – regulation and tax considerations

-

Redundancy and Failover – high availability and disaster recovery

Below is a list of the different business model approaches in the network validation space.

Types of Staking:

-

Solo Staking

-

Staking-as-a-Service (StaaS)

-

DeFi Pooled Staking

-

CEX Staking

-

Layer 2 Native Staking

This section serves as comparative statics between the leaders of each lane and ValiDAO. Native L2 staking and solo staking have been left out of this comparison – Native L2 staking is closer to an ancillary service than it is to a core business, and solo staking is not a ‘business’ in the traditional sense.

We have outlined the leader in each category below:

-

CEX Staking – Coinbase

-

StaaS – Figment

-

Pooled Staking – Lido

It is also important to note that these protocols/businesses ‘interoperate’ with one another – i.e Lido uses Figment as a staking service provider. In that sense, some of the AUD is double counted.

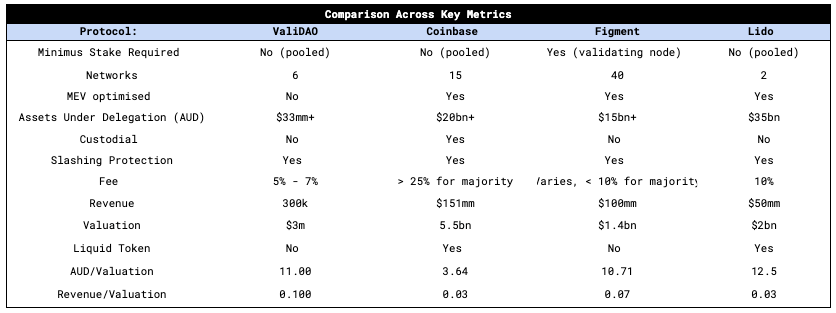

Accurate as of 06/06/24

ValiDAO stands out among the industry leaders due to the efficiency of managing assets and generating revenue relative to its market valuation. Looking at the AUD/Valuation, we can see the value of assets delegated per unit of market capitalisation. Lido, Figment, and ValiDAO all trade at a relatively similar AUD per unit of valuation, while Coinbase’s staking program appears to have a very low AUD per unit of valuation.

However, it’s the revenue per unit of valuation metric where ValiDAO really sets itself apart. It’s 50% more profitable than Figment while being 3x more profitable than Lido and Coinbase staking – all on a per unit of valuation basis. Put differently, for every $1 of Market cap (valuation), ValiDAO generates 10c of revenue, Figment generates 7c of revenue, while Lido and Coinbase only generate 3c of revenue. Again, this is a clear illustration of a relative undervaluation.

Moreover, ValiDAO generates sector leading Revenue/Valuation figures while operating with the lowest take rate. Their fee is 5% - 7%, while the fees of the industry leaders are 10%+ and an astonishingly high 25% in the case of Coinbase.

It’s important to understand that ValiDAO is only 6 months old, but its superior efficiency positions it as a lean, high-growth entity in the staking ecosystem. It’s an industry leader in take rate and revenue per unit of valuation, while its AUD per unit of valuation trades at parity with far more mature companies.

Thesis

Evergreen Narrative

The crypto markets are driven by hype cycles, sectoral themes and ‘narratives’, leaving some tokens out of favour for month at a time when their sector is not attractive to investors. ValiDAO on the other hand benefits from an evergreen narrative due to its capacity to rapidly deploy infrastructure on new and promising emerging chains and protocols. This capability provides it with an ever-expanding and nearly infinite opportunity to capitalise on the latest trends within the industry. New chains (Bera, Monad), new primitives (restaking, liquid staking, modularity & MEV infra)

In contrast, most other projects are confined to specific niches, limiting their potential to generate widespread attention and viral moments. In an environment where attention is highly sought after and new protocols and chains emerge rapidly, maintaining relevance can be challenging. Projects that lack the nimbleness to adapt and gain exposure to new developments risk adverse consequences on their longevity. ValiDAO’s flexibility and adaptability ensure it remains at the forefront, capable of thriving in a fast-paced and ever-changing landscape.

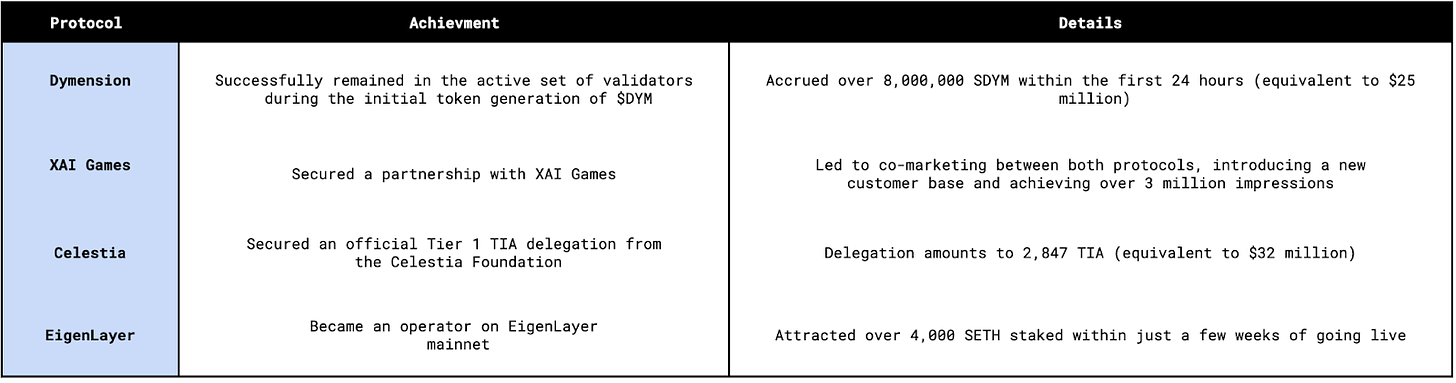

Since its inception 6 months ago, ValiDAO has successfully integrated with a variety of the leading protocols within the industry. Below is an overview with the respective actions taken:

ValiDAO additionally exemplifies an evergreen narrative through its inherent flexibility and responsiveness to emerging trends in the blockchain ecosystem. The successful integrations with leading protocols such as Dymension, XAI Games, Celestia and EigenLayer underscore ValiDAO’s ability to rapidly deploy and manage validator nodes on the latest and most innovative chains. This continuous engagement and relevance within the ever-evolving landscape positions ValiDAO at the forefront of new blockchain technologies, allowing it to tap into fresh opportunities and attract delegators seeking to stake their assets on cutting-edge networks.

ValiDAO’s adaptability not only secures its place as a key player in the industry but also leverages the potential for higher returns and growth driven by the success and adoption of new chains. By combining infrastructure ownership with active participation, ValiDAO remains a dynamic and influential force capable of evolving with the market and maintaining its relevance over time.

Revenue Generation

At a $3.4M FDV, we believe VDO is attractively priced at a P/S ratio of 9.81, lower than the staking industry standard which sits between 12-14 P/S multiple. Given the growth prospects of ValiDAO and their ability to gain AUD, we expect the valuation to increase in line with AUD. The main goal and therefore KPI is ValiDAO’s AUD and the revenue they generate from it. As we detailed in the valuation section, an AUD of $1B should generate an estimated $4M in yearly revenue with low operating expenses. The validation business is one of the most sustainable we find within the crypto industry and thus we see ValiDAO as a long-term business with prospects of growing even during crypto bear markets.

Token Economics

This cycle, we have started to see crypto native investors become disillusioned with the predatory tokenomics of VC-funded projects. We have seen a number of token economic models this cycle which have not favoured retail investors such as the ‘low float/ high FDV meta’ with large ‘insider’ allocations and more recently we have seen large PoS chains allow locked VC / team tokens to participate in validation, earning liquid rewards throughout their investment cliff. This has led to a steady sell off as insiders unlock or claim staking rewards.

Contrary to this, the VDO token was fair-launched with 80% of the supply placed into a Uniswap LP. The team allocation of 10% is lower than the industry standard and the team have entered into token cliffs and vesting schedules highlighting their long-term commitment.

Akin to the traditional DePIN tokenomic flywheel, the VDO token accrues value through buybacks. Unlike the majority of buybacks we see, such as buyback & burns and to some extent buyback & LP, the VDO buyback is for the express usage in the growth of the protocol, something we think is vital at any early stage project. Buyback and burns should be put in place when the project has matured and there is no better use of the capital / incentive. With such a clear conversion of AUD to revenue, the VDO buybacks should be focussed on garnering new AUD through various incentivisation mechanics, such as the DYM airdrop proposal. A few other ideas could be applying for the Lido Alliance and contributing a % of supply to that, or executing the airdrop strategy with a new chain such as Berachain.

Growth Prospects

There are a number of high value prospects we see on the horizon for ValiDAO to expand and gain AUD:

-

New PoS Chains - Being early to new PoS chains can establish ValiDAO as an incumbent with a large amount of stake. A few examples: Berachain, Monad, Initia & Seda.

-

Large Chains - ValiDAO establishing their brand and track record can look to become big players in large chains such as Solana and Ethereum. The decentralisation benefits of ValiDAO’s bare metal servers in underrepresented regions makes them an attractive addition to any chains validator set. A couple of ideas: Solana recently removed a number of validators from their delegation program for breaking their MEV policy, we believe ValiDAO could be a great addition here. LidoDAO emphasises and select new node operators based on their decentralisation on a number of verticals (geography and client selection). ValiDAO would be a decentralising addition to their validator set and with it, they could gain >$1Bn in TVL.

Risks

-

Smart Contract & Security Risk - Like all protocols working in crypto, there is a very real risk that comes from building and working with smart contracts. Any bug or hack can result in a loss of funds.

-

Performance Risks - When operating validators, maintaining optimal uptime and high performance is crucial to ensuring the accrual of intended rewards. Poor performance can lead to a significant loss of rewards, and prolonged offline periods or misconfigurations can expose assets under delegation to slashing risks imposed by the protocol. These slashing events result in financial losses and erode user confidence. However, the risks associated with slashing are often exaggerated, as it is typically a gradual process. Additionally, ValiDAO has real-time systems in place to swiftly reconfigure validators and mitigate potential issues.

-

Adoption Risk - There is a risk that ValiDAO may fail to grow assets under delegation, resulting in low revenue generation. Additionally, as seen with high-revenue projects like Rollbit, investor mindshare and sentiment can significantly impact a project’s valuation despite strong revenue figures.

-

Competition Risk - The staking industry is a major sector in the crypto space, aiming to capture tens of billions in annual revenue, which makes it fiercely competitive. Competitors range from centralized exchanges and institutional staking providers to decentralized staking protocols, each offering unique products. Success in onboarding new PoS networks hinges on being early, delivering strong performance, and building a recognizable and influential brand. For ValiDAO to thrive, it must be early to testnets and accumulate delegations to secure inclusion in mainnet validation.

-

Regulatory Risk - In a number of cases (Kraken & Coinbase), the SEC contends that staking activities can fulfil the criteria of an investment contract, thereby classifying them as securities under U.S. federal securities laws. According to the “Howey Test,” three elements must be present: an investment of money, a common enterprise, and an expectation of profits primarily from the efforts of others. The SEC argues that, under certain conditions, staking meets these criteria. Whilst ValiDAO operates outside of the US regime and has no central authority, US regulations can inhibit adoption. Further, the value accrual mechanism of the VDO token via buybacks could also classify VDO as a security.

Appendix

Additional Product Offering

Stargaze: Staking, RPC, and IBC Relayer

Stargaze is a community owned network designed specifically for the creation, sale, and exchange of NFTs. Stargaze aims to provide a seamless user-friendly platform for artists, creators, and collectors to engage with NTFs.

Cosmos Hub: RPC and IBC Relayer

Cosmos Hub is the central blockchain in the cosmos ecosystem, designed to facilitate interoperability between multiple independent blockchains. Leveraging the Inter-Blockchain communication protocol (IBC), Cosmos Hub enables seamless communication and data exchange between blockchain networks, creating an ‘internet of blockchains’.

Injective: RPC and IBC Relayer

Injective enables fast, secure, and fully decentralised trading of a wide range of financial products, including spot, futures, and derivatives. Built on the Cosmos blockchain, it offers a high-performance, scalable platform that eliminates the traditional barriers of centralised exchanges such as high fees and lack of transparency.

Juno: IBC Relayer

Juno is an open-source smart contract platform built on Cosmos, it’s designed to offer a scalable and secure environment for deploying interoperable smart contracts. This allows developers to create and run complex dApps efficiently, Juno enhances the functionality of smart contracts by enabling seamless communication and interaction between different blockchains through IBC.

Secret Network: IBC Relayer

Secret Network is a privacy focused blockchain platform designed to enable secure, confidential transactions and smart contract deployment. Unlike traditional blockchains where all data is public, Secret Network employs advanced encryption techniques to keep data private while still ensuring transparency and security.

Neutron: IBC Relayer

A versatile smart contract platform designed to enhance the interoperability and functionality of decentralised applications within the cosmos ecosystem. Neutron leverages the IBC protocol to enable seamless communication and data transfer between different blockchains, fostering a more integrated and scalable decentralised environment.

Osmosis: IBC Relayer

Osmosis is a decentralised exchange (DEX) and automated market maker (AMM) protocol built on Cosmos, it’s designed to enable seamless and efficient trading of digital assets across multiple blockchains via the IBC protocol. Osmosis allows users to create and manage custom liquidity pools, offering flexible and dynamic fee structures that incentivise liquidity providers.

Stride: IBC Relayer

Stride is a platform designed to provide seamless and efficient staking services within the Cosmos ecosystem. It leverages IBC to help users stake their assets across multiple blockchains, maximising yield and enhancing security.

Secret: IBC Relayer

Secret is a blockchain platform that prioritises privacy by enabling confidential transactions and private smart contracts. Unlike traditional blockchains, where all data is publicly accessible, Secret ensures that sensitive information remains encrypted and accessible only to authorised parties.

Regen: IBC Relayer

Regen is a blockchain platform focused on environmental sustainability and regenerative finance. Built on the Cosmos SDK and leveraging the Tendermint consensus algorithm, Regen enables the creation and trading of ecological assets and services, such as carbon credits and biodiversity tokens

Sentinel Hub: IBC Relayer

Sentinel Hub is a decentralised network designed to provide secure and private internet access through a distributed Virtual Private Network (dVPN), it allows users to share and utilise bandwidth in a peer-to-peer manner, ensuring that internet usage remains private and uncensored. Users can access the network to route their internet traffic through multiple nodes, enhancing privacy and security by obscuring their online activities.

Evmos: IBC Relayer

Evmos is a decentralised blockchain platform designed to bring Ethereum-based applications and assets to the Cosmos ecosystem. By leveraging the Ethereum Virtual Machine (EVM) and the Cosmos SDK, Evmos enables seamless interoperability between Ethereum and Cosmos blockchains. This allows developers to deploy smart contracts and decentralised applications (dApps) written in Solidity, the primary programming language for Ethereum, while benefiting from the scalability, security, and interoperability features of the Cosmos network.

Umee: IBC Relayer

Umee is a decentralised finance (DeFi) platform designed to enable seamless cross-chain lending and borrowing of digital assets, it leverages the Inter-Blockchain Communication (IBC) protocol to facilitate interoperability between various blockchain networks. This allows users to access and manage their assets across multiple blockchains in a unified and efficient manner.

Agoric: IBC Relayer

Agoric is a decentralised platform focused on enabling secure smart contracts and robust decentralised applications (dApps) using JavaScript, a widely-used programming language. Built on the Cosmos SDK and leveraging the Tendermint consensus algorithm, Agoric aims to simplify the development of blockchain applications by providing developers with familiar tools and a secure, scalable infrastructure.

Crescent: IBC Relayer

Crescent is a decentralised finance (DeFi) platform designed to enhance liquidity provision and trading efficiency within the Cosmos ecosystem, it leverages IBC to enable seamless and secure interactions between different blockchain networks. The platform offers advanced features such as automated market making (AMM), decentralised exchanges (DEX), and yield farming, allowing users to earn rewards by providing liquidity and participating in various DeFi activities.

IRISnet: IBC Relayer

IRISnet (IRIS Network) is a blockchain platform designed to facilitate the integration and interoperability of various distributed ledger technologies (DLTs), it aims to provide a robust infrastructure for building distributed business applications. IRISnet also focuses on creating a decentralised service infrastructure, allowing businesses to develop and deploy complex services and applications with ease.

Gravity Bridge: IBC Relayer

Gravity Bridge is a decentralised protocol designed to facilitate the transfer of assets between the Ethereum and Cosmos blockchain ecosystems; it employs a highly efficient and secure mechanism to enable interoperability between these two major blockchain platforms. The protocol uses a system of validators to ensure the accuracy and security of cross-chain transactions, allowing users to seamlessly move their Ethereum-based assets to the Cosmos network and vice versa.

Quicksilver: IBC Relayer

Quicksilver is a decentralised platform designed to streamline and enhance the process of staking assets within the Cosmos ecosystem, it introduces a liquid staking solution that allows users to stake their tokens while still retaining liquidity. This means users can earn staking rewards without locking up their assets, providing them with the flexibility to trade or use their tokens in other DeFi applications.

Persistence: IBC Relayer

Persistence is a blockchain platform focused on providing a robust infrastructure for institutional-grade decentralised finance (DeFi) applications, it aims to bridge traditional finance with decentralised finance by offering a suite of products that cater to various financial needs, including staking, lending, and synthetic assets.

Persistence’s ecosystem supports a range of applications, from liquid staking solutions to enterprise-grade asset management, enabling users to maximise yield and manage risks effectively.

Comdex: IBC Relayer

Comdex is a decentralised finance (DeFi) platform designed to revolutionise the commodity trading industry by leveraging blockchain technology, it offers a comprehensive ecosystem that facilitates seamless and transparent trading, settlement, and financing of commodities. Comdex provides users with a range of DeFi services, including synthetic asset creation, decentralised exchanges (DEX), and lending, allowing for efficient and secure transactions.

Crypto.org Chain: IBC Relayer

Developed by Crypto.com, Crypto.org Chain is a high-performance, decentralised blockchain network designed to facilitate secure, scalable, and low-cost transactions for cryptocurrencies and decentralised applications (dApps). It aims to accelerate the global adoption of blockchain technology by providing a user-friendly and efficient infrastructure for payments, DeFi, and other blockchain-based services.

e-Money: IBC Relayer

e-Money is a blockchain platform designed to issue and manage a variety of digital currencies backed by traditional fiat currencies, offering a stable and transparent alternative to traditional cryptocurrencies. The platform supports multiple fiat-backed stablecoins, which are fully collateralized and audited regularly to ensure trust and stability. These stablecoins can be used for seamless cross-border payments, remittances, and decentralised finance (DeFi) applications, promoting financial inclusion and reducing transaction costs.

Disclaimer:

The information and services above are not intended to and shall not be used as investment advice.

You should consult with financial advisors before acting on any of the information and services. ASXN and ASXN staff are not investment advisors, do not represent or advise clients in any matter and are not bound by the professional responsibilities and duties of a financial advisor.

Nothing in the information and service, nor any receipt or use of such information or services, shall be construed or relied on as advertising or soliciting to provide any financial services.